An Opportunity for a Timely Wealth Transfer

There’s still time to take advantage of the outsized estate tax exemption, but that window is closing.

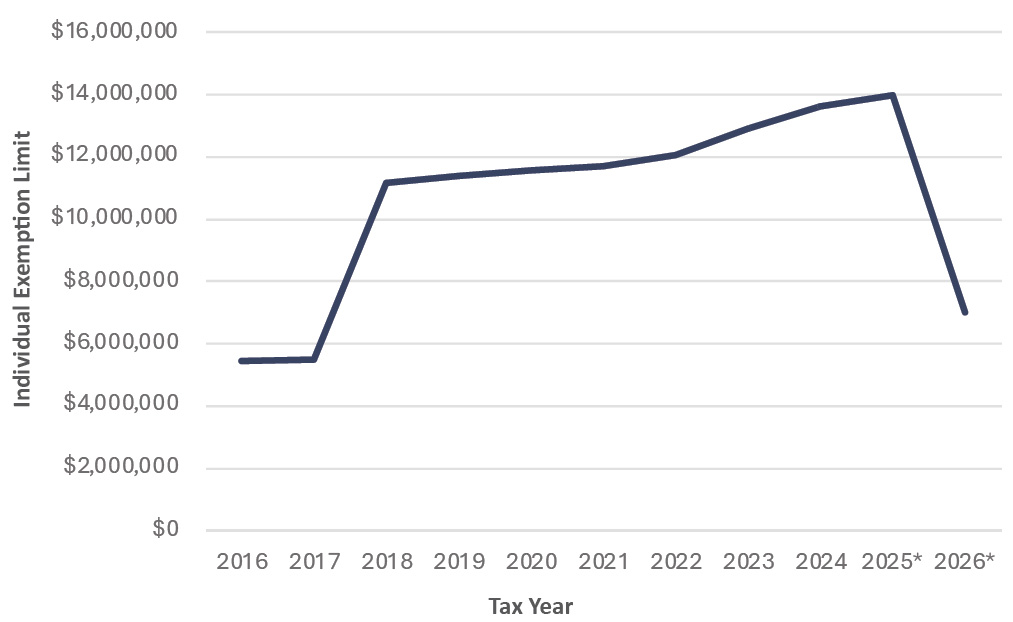

In 2017, Congress passed the Tax Cuts and Jobs Act, which increased the amount of money you can transfer from your estate, either during your lifetime or at death, without incurring the standard 40% gift and estate tax. In 2024, this amount – called the lifetime gift and estate tax exemption – is $13.61 million per person, or $27.22 million per married couple.

However, barring additional action from Congress, the lifetime gift and estate tax exemption is scheduled to revert to pre-Tax Cuts and Jobs Act levels on January 1, 2026. Were that to pass, a single individual could end up paying more than $3 million in additional estate tax, and a married couple could pay more than $6 million extra.

Lifetime Gift and Estate Tax Excemption

2016-2026

The increased lifetime gift and estate tax exemptions would sunset after 2025 without additional legislation from Congress.

*projected, if current law sunsets

When it comes to this opportunity, our planning varies across three scenarios:

Household Net Worth

Planning Need

Individual:

Below $7 million

Married:

Below $14 million

If you fall into this category, you fall in line with 99% of American households. Even if the exemption amount does fall to around $14 million, you should have little concern over the federal estate tax. However, while estate tax planning may not be important, estate planning is still vital for securing a strong financial future. Your Baird Financial Advisor can help review your existing estate plan to ensure it still meets your family’s needs.

Individual:

Between $7 and $15 million

Married:

Between $14 and $30 million

If your net worth falls somewhere between these amounts, you have the most to discuss with your Baird Financial Advisor. While today you might not have any estate tax issues, you could be facing a multi-million-dollar tax cost if the sunset does occur. Talk with your Baird Financial Advisor to discuss what planning strategies make most sense for you.

Individual:

Above $15 million

Married:

Above $30 million

If your net worth falls into this category, it is unlikely the lifetime exemption will ever be large enough to eliminate your need for estate tax planning. Because of this, you should already be in contact with your estate attorney, Baird Financial Advisor and other advisors to ensure your estate plan is up to date with current tax laws.

Could This Exemption Change?

While there is a possibility the provision could be extended or modified by Congress, there’s no guarantee that it will. Tax laws are never permanent, and with an upcoming presidential election, it’s impossible to predict where this might land. It is important to talk with your Baird Financial Advisor to explore what strategies are available, even if you ultimately decide not to take advantage of this increased exemption.

How Your Baird Financial Advisor Can Help

Your advisor, working in partnership with Baird Trust’s planning experts, is well-equipped to discuss and analyze any options available to you. And by working with your other tax and legal advisors, they can help develop a plan that is best tailored to your overall situation. Whether you are facing potential estate tax liability now or think you might in the future – or even if you just need to review your existing plan to ensure it still meets your family’s needs – your Baird Financial Advisor and team of trust specialists are ready to help.

If you’re interested in learning more about legacy planning, including tax implications, family dynamics and charitable giving, consider watching our recent webinar, “Passing the Torch: Thoughtful Strategies for Wealth Succession".

Baird Trust Company (“Baird Trust”), a Kentucky state-chartered trust company, is owned by Baird Financial Corporation (“BFC”). It is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), an SEC-registered broker dealer and investment advisor, and other operating businesses owned by BFC. Past performance is not a predictor of future success. All investing involves the risk of loss and any security may decline in value. This is not intended as a recommendation to buy any security and views expressed may change without notice. Baird Trust does not provide tax or legal advice. This market commentary is not meant to be advice for all investors. Please consult with your Baird Financial Advisor about your own specific financial situation.