What Can Bonds Do for You?

Let’s face it: When compared to the sizzle of stocks or cryptocurrency, the prospect of investi ng in bonds can feel a little…underwhelming. But what bonds might lack in pizzazz, they make up for in utility. Here are five underappreciated benefits when introducing bonds into your portfolio.

1. Bonds Can Provide Dependable Income

As a rule, stocks are inefficient income-producers: Most financial gains in the stock market are realized by the sale of a given security – until that stock is sold, those gains exist only on paper. (Some blue-chip companies can offer their investors income via dividends, but the dividends from these companies are not guaranteed. For example, earlier this year, drugstore chain giant Walgreens cut its dividend by nearly 50% and Intel stopped paying its dividend entirely – and some companies like Amazon and Tesla have never paid dividends.) Most bonds, on the other hand, are designed to make regular, fixed interest payments until maturity. Short of the financial failure or unviability of the underlying organization, those interest payments can create a reliable income stream. The amount of income available from bonds at any given time will be impacted by the current interest rate environment and other factors such as maturity and creditworthiness of the issuing entity.

2. Bonds Can Build Your Community

Municipal bonds not only provide diversification and tax advantages to the investor – they benefit the public as well. Municipalities often rely on municipal bonds to fund the projects that build a community, such as roads and bridges, schools, hospitals, even sewage treatment plants. It’s a rare investment that can have such a positive societal impact. As a specific example, earlier this year the County of Erie New York issued general obligation bonds to fund a new football stadium for the NFL’s Buffalo Bills. The Bills are anticipated to begin their 2026 season in the new stadium, with the old stadium demolished and converted into a parking area.

3. Bonds Offer Capital Preservation

Especially for those in retirement, who are more likely to be drawing down their financial reserves rather than building them up, preserving as much of their capital as possible is a priority. The relative safety of bonds as well as their ability to return principal (if held to maturity) while adding yield make bonds a popular choice for reti rees, who might not have the time to recoup their losses following a downturn in the stock market.

While it’s true that every investment carries some degree of risk, it’s also true that some investments are significantly riskier than others. One of the more unique aspects of bonds is their predictability: Assuming the solvency of the issuer, bond investors know the exact dates of their interest payments and return of principal and how much to expect on those dates. For investors put off by the volatility of the stock market, this predictability offers a degree of certainty that can make it easier to sleep at night.

4. Bonds Can Pinpoint Future Cashflow

Bonds’ predictability can be an incredibly useful feature for investors who anticipate a significant, fixed expense in the future. For example, let’s say you’re expecting a major tax bill in April, or you want to buy out the car you’ve been leasing and have a significant residual value to account for. Through bonds, you can arrange it so interest payments or the return of principal coincide with these major expenses. Aligning bond maturities with anticipated financial needs ensures investors have the required funds available on time, every time.

5. Bonds Can Cushion Portfolio Volatility

A common strategy for managing investment risk is diversification – intentionally spreading your investments over a variety of dissimilar and uncorrelated assets, so that a downturn in one area of the market doesn’t have an outsized impact on your portfolio. It’s a critical aspect of a well-balanced investment portfolio, and bonds provide an effective means to achieve it. Because bonds often behave differently than stocks, by including bonds in a portfolio, investors can reduce overall risk and better participate in the markets’ historical trend of generating returns over time.

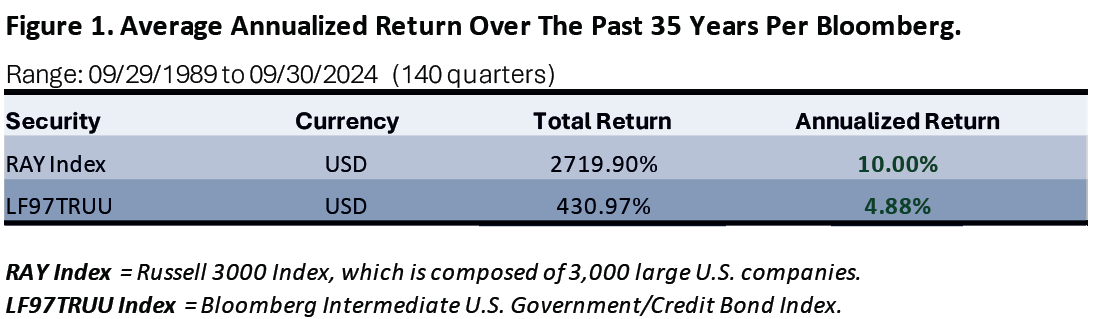

Historically, stocks have provided investors with greater returns compared to bonds – 10% annually for stocks compared to roughly 5% annual average return for bonds over the past 35 years (see Figure 1). However, stocks also tend to be a much more volatile investment, and the ups-and-downs of the market might be hard for investors to tolerate – especially retirees who rely primarily on their investments to fund their retirement. However, the conditions that provide headwinds for stocks often provide tailwinds for bonds, and thus an allocation to bonds becomes a useful cushion that tempers periodic market drawdowns inherent in investing.

Baird Trust Company (“Baird Trust”), a Kentucky state chartered trust company, is owned by Baird Financial Corporation (“BFC”). It is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), (an SEC-registered broker-dealer and investment advisor), and other operating businesses owned by BFC. Neither Baird nor Baird Trust provide individualized tax, accounting or legal advice. Please consult your accountant or attorney for personal tax, accounting or legal advice.